Key Differences between Invoice Finance and a Fintech SME Lender

When comparing the invoice finance product to one of the fintech SME loans provided by companies like Prospa, Get Capital or Banjo, a broker recently said to us, “aren’t you guys all the same?”

Invoice finance and fintech SME lenders are truly different beasts. Each suit different businesses and circumstances in their own way. Both provide tools to SMEs to help their business grow and drive revenue. A working understanding of the differences is useful for brokers and accountants who advise small and medium businesses. This information is especially relevant for those facing cash flow management challenges.

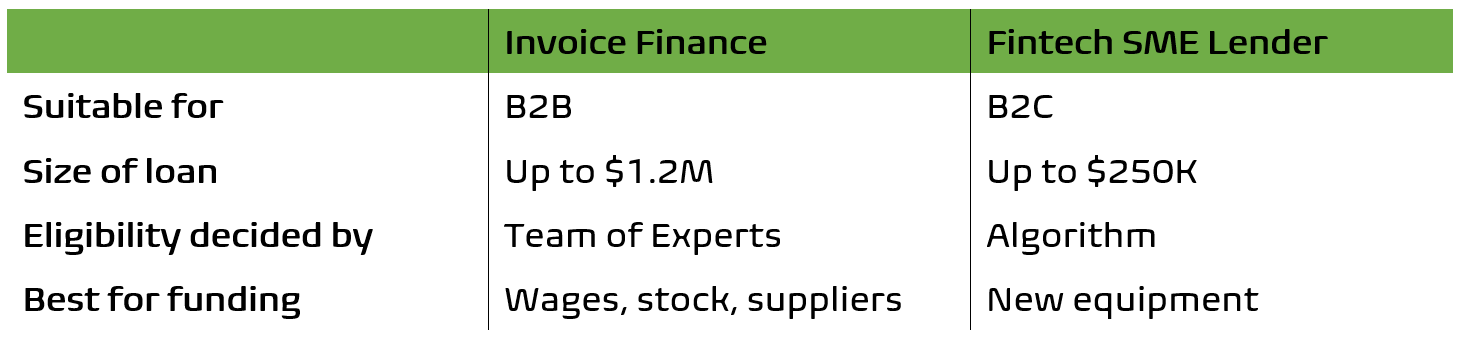

In summary, the key differences are highlighted in this table

Read on to discover the detailed differences between Invoice Money and the current suite of fintech SME loan providers.

The Potential Size of the Loan

An invoice finance provider will lend approved businesses up to $1.5M. A fintech will generally lend up to $250k.

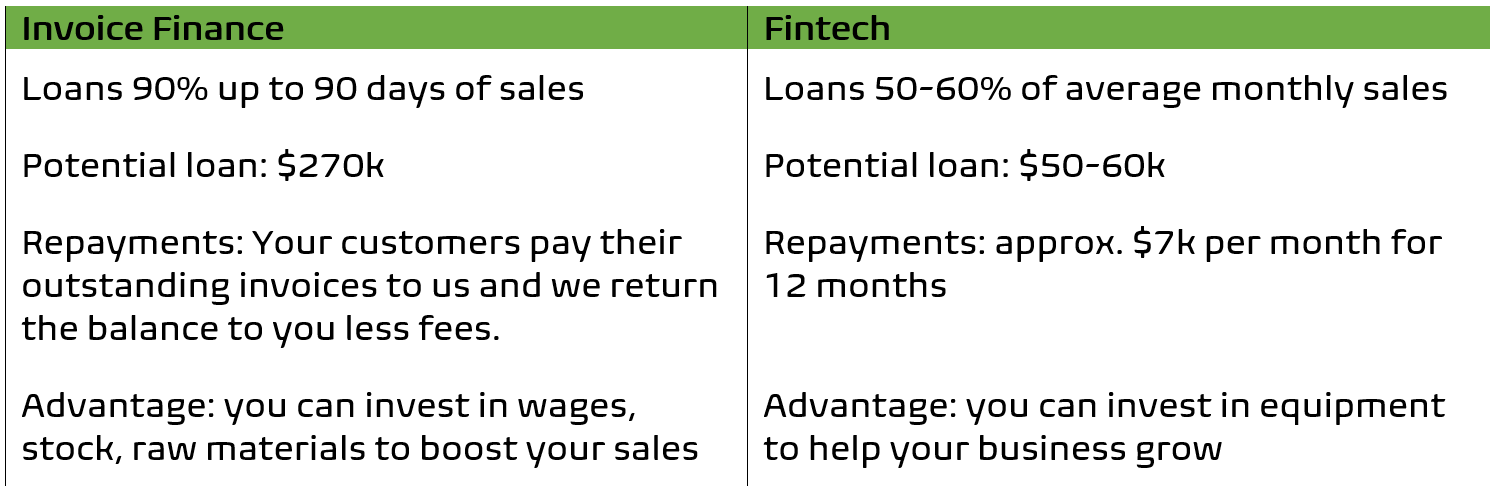

A fintech is usually a provider of a term loan. They look at your annual trading figures and take an average monthly sales figure. They will then lend you 50-60% of average monthly sales. You then pay back the loan over the course of 12 months in installments.

This is quite different to a provider of invoice finance. At Invoice Money we can fund up to 90% of your outstanding invoices. This can actually be up to 2-3 months of sales. In some circumstances an approved customer may actually be able to get a larger loan from an invoice financer than a fintech.

The Type of Business

Invoice Money is a finance provider to SMEs who are product and service providers to other businesses (B2B). Invoice finance is a true cash flow funder and is suitable for funding wages, raw materials and stock.

Fintechs are generally more suited to businesses that serve consumers (B2C). A fintech SME loan can be suitable for funding equipment purchases.

As Your Sales Grow, So Does Your Finance

As your sales grow, an invoice finance provider is able to lend you more and more. At Invoice Money we understand that you have to spend more to make more. Increased sales are often a product of increased raw materials or stock purchases or a higher wage bill.

A fintech will contract you to pay monthly principal and interest payments to reduce the loan balance. Because they are focused on your annual turnover and average monthly sales figures, they are unlikely to be able to advance you more than 50-60% of your historical monthly sales, even if you have won a big new customer and are doubling your turnover.

How Eligibility is Determined

At Invoice Money our experienced team review your business and invoices and determine whether we are a good fit for each other. Our solutions are fully flexible and include single invoice, progress payments, selective invoice finance and even whole turnover solutions. The best bit about the Invoice Money team is that they are SME experts who help businesses like yours every day of the week. They hold your hand through the process and get you the most suitable bespoke finance solution for your business.

A fintech will often use an algorithm to assess your suitability for finance. They will generally expect you to apply online and figure it out for yourself.

Poor Past Company Performance

You might have had a rough year of sales with a new competitor coming on the market, or invested big in scaling up and the profit and loss looks less than enticing. When an invoice finance provider is assessing whether your business is factorable, you need to have business to business invoices outstanding. Your profit and loss over recent years is not an issue.

An Invoice finance company can even fund a distressed business that needs help dealing with a cash flow crisis.

There may be a completely valid reason why your business is under pressure. You might be buying out a partner or weathering the downstream impacts of the current drought. At Invoice Money we can fund the cash tied up in your debtors, we don’t need proof you are profitable in the long term.

Application Fees

Invoice Money charges no application fees or legal fees. You can even informally apply so that you know you are suitable when you need us.

A fintech will want you to complete a full application.

A working example of the differences in practice.

Take a thriving B2B SME business who is turning over $1.2M per annum.

Invoice finance is particularly suitable for manufacturing, importers, wholesalers and distributors.

We also regularly do business with printers, transport, earthmoving, logistics and labour hire companies.

The many businesses we deal with who are using invoice finance regularly to fund either single invoices, single customers or even total turnover find they have a competitive advantage. They are able to manage their cash flow to pay suppliers and wages in a way their competitors just can’t always do.

To find out more about how we can help SME businesses in times of tight cash flow, give our friendly team a call for a confidential discussion about how an invoice finance facility can work for your business.

Invoice Money is the Invoice Finance provider of choice for SMEs. You can contact our friendly team here.